Mission Lane Credit Card Login, Payment & Visa Cards

With Mission Lane Credit Card Login, you can access and manage your account via the website and mobile app easily. In this article, Bubblonia will share with you how to access, make payment, reviews of Mission Lane credit cards, including Visa cards and contact customer service.

Bubblonia’s Summary

- Mission Lane reports your credit activity to the top three consumer credit reporting agencies.

- Free access to credit score for cardholders.

- You can pay for your Mission Lane Visa credit card online through the card login.

Mission Lane Visa Reviews

Can Help You Build Credit

If you can apply, the Lane Visa® credit card can help you build credit without making a down payment.

Mission Lane reports your credit activity to the top three consumer credit reporting agencies. While this is a common feature of a credit card, it doesn’t make it any less important.

The benefits

The Mission Lane Visa credit card is packed with benefits, some of which are also offered by Visa:

- Always access to your account.

- No liability for fraud.

- Between 1% and 1.5% back on all purchases.

- Higher line of credit over time.

- Free access to credit score for cardholders.

- No deposit required.

- Immediate decision on the pre-approval of the applicant’s loan.

- No interest on purchases when you pay in full and on time every month.

Credit Card Limit Ability To Level Up Over Time

The issuer of this Visa® credit card will also periodically review your accounts to determine if you qualify for a higher credit limit. A higher limit can help keep your credit usage low – if your spending habits don’t change. And credit utilization is one of many key factors in credit scoring models, so if managed properly it can help your account scores.

Since the card’s recommended FICO score is poor to fair (300 to 669), it appears that the Mission Lane Visa® credit card does exactly what it says it does – and not much more.

Mission Lane states that if your account remains in good standing after you make your first six payments on time, you may qualify for a higher credit limit. In addition, an assessment will be made at least once within the first 12 months after opening the account to determine whether you are eligible for an increase in your credit limit. Several factors are taken into account in this process.

- Timely payment history

- Whether the accounts have ever exceeded the credit limit

- Or the charging rights are limited

- Whether you have closed the accounts or filed for bankruptcy

- Whether you can afford the higher credit limit

High Interest Rates Can Cost You

The Visa® credit card has a high APR of 29.99% for variable purchases (you may see other offers on Credit Karma). While high APRs are common on credit cards aimed at people trying to build credit or who have no credit history at all, lower APRs can be found on other options.

The annual fee may put you off

The Mission Lane Visa® Credit Card comes with a $59 annual fee. (You may see other offerings on Credit Karma.) This card doesn’t offer a rewards program, so you don’t have the option to offset this fee against rewards when you use it. shops. The only value of the card – if you can apply for it and are approved for it – is to access credit and potentially build your credit profile for the future.

Mission Money™ Visa® Debit Card

Mission Lane’s Mission MoneyTM Visa® debit card is a simple prepaid and debit card. The Mission MoneyTM is billed as “a better kind of debit account”, and it’s easy to see why. FDIC insurance covers Mission Money accounts up to $250,000.

- No account fees or minimum balances required

- No fees for transferring money to and from your Mission Money acc. No charges for contacting support teams by phone or online.

- There are no inactivity fees.

- There is no ATM surcharge in the network.

- There is no charge for checking your ATM balance.

- There are no foreign transaction fees.

Mission Lane Credit Card Review – What Are The Pros And Cons?

Advantages

- Available with a less than ideal credit history, making it a good entry-level card if you need to build or rebuild your score

- Since it’s an unsecured card, you don’t need to deposit any money to get started

- The annual fee is relatively low compared to many other unsecured cards available to those with damaged credit histories

- After six months of responsible card use and timely payment, you may qualify for a higher credit limit

Disadvantages

- Has a sky-high APR, even for a credit card, making it a risky choice if you’re inexperienced with credit or struggling to pay off your balance each month

- Many secured cards do not charge an annual fee, and because your deposit is refunded, they are less expensive than the Mission Lane card

- The $300 minimum starting credit limit isn’t particularly impressive

- Each cash advance is charged $10 or 3% of the amount of the advance, whichever is greater

A Deeper Insight Into Current Map Offerings

- Quick Highlights

- Reward percentage: N/A

- Welcome Offer: N/A

- Annual Fee: $0 – $59

- Buy Introductory APR: N/A

- Balance Transfer Introductory APR: N/A

- Regular APR: 26.99 – 29.99 percent (variable)

Mission Lane Credit Card Login – Online Access

To get the most out of your Mission Lane Visa card, you need online access. To do this, you must register online with your personal information.

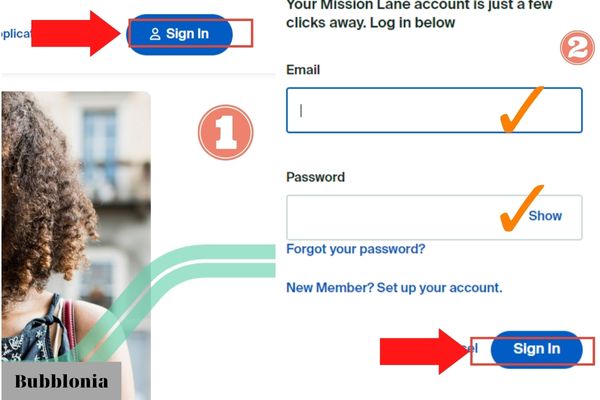

Mission Lane Login

Follow this tutorial to create an account and manage your Lane credit card

- Go to the missionlane.com website

- Click the “Sign In” button in the right corner

- In the new tab, enter your email address and password

- Click on “Sign In” button

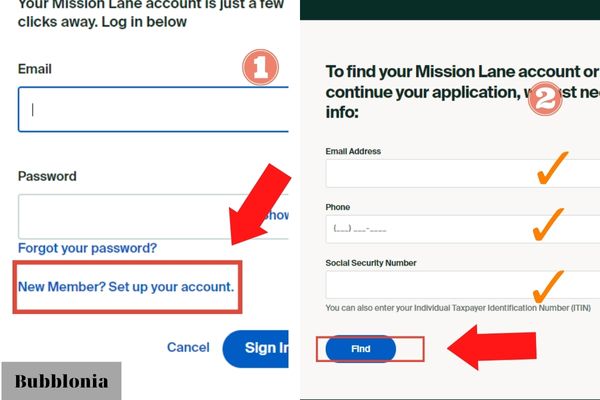

Register Online

- To register online, click “New member? Set up your account” to begin the process.

- The system first checks whether you already have an account, which requires you to enter your email address, telephone number and social security number.

- Then simply click “Find” and proceed, providing additional information when prompted.

Forgot your password

If you forgot your Mission Lane Visa login password

- On the login page, simply click on “Forgot your password?“

- Enter the email address that you used to open the account.

- Below you can choose to have a code sent to your phone or receive a call to reset your password and regain access.

Mission Lane Credit Card Services

Mission Lane Phone Number For Credit Card Billing

At the time of writing, there is no public phone number, but you can still check the back of your Mission Lane Visa credit card to reach customer service or pay over the phone.

Credit Card Address Of Mission Lane

If you want to pay by mail, you can use the following address:

mission gone

PO Box 23075

Columbus, GA 31902-3075

Mission Lane App

You can download Mission Lane from Google Play and the App Store. Then open the app on your mobile device to enter your email address and password.

Read more about mobile banking: hdfc net banking mobile , mercury credit mobile

If you are having problems downloading the app, these problems could be:

App updates freeze and never download completely

Problems downloading or installing apps, games, or media from the Google Play Store

Apps downloaded from the Google Play Store fail to open or open and crash

Here’s How To Fix It

Make sure you have a strong internet/wifi connection

Step 1: Clear cache in Settings (step-by-step screenshots below)

- Go to your Android device’s Settings app

- Select Apps & notifications, then select See all apps

- Scroll down and select Google Play Store

- Select Storage & Cache (depending on your device, this may only be Storage)

- Select Clear cache (this will not affect your

- Then select Clear Data (this may also be called Clear Storage depending on your device)

Step 2: Repeat the download

Once it’s done, open the Google Play Store again and try to complete the download

How To Make Mission Lane Credit Card Payments

There are several ways you can pay for your Lane Visa credit card. You just need to choose the one that is most convenient depending on your internet access and other aspects to make login payments.

Online

You can pay for your Mission Lane Visa credit card online through the card login. Just log in to your internet banking account and go to the payment section.

By phone

If you want to pay by phone, look for a phone number on the back of your card, as there isn’t a public number anywhere else.

By mail

If you do not have online access or are having communication problems, please send your check or money order to the above address.

Via The Mobile App

Another online alternative is to pay your credit card bill through the Mission Lane app for iOS and Android. All you have to do is download it – if you haven’t already – and log in to proceed with the payment.

How To Avoid Late Fees

Mission Lane charges a late payment fee of between $0 and $7 if you do not deposit the full minimum deposit into your account by the payment due date. However, they do not charge more than the minimum amount due.

The best way to avoid late charges is to use the auto-pay feature via login. You can also call 1-855-570-3732 to activate.

Final Thoughts

With no down payment required and multiple benefits, the Mission Lane credit card is a solid opportunity for those without an honest credit history. The annual fee can be quite low in certain circumstances, but make sure you have accurate information about all the features you want to use through a credit-building card.

Frequently Asked Questions